金融市场泛指进行证券交易的任何市场,包括股票市场、债券市场、外汇市场和衍生品市场等。金融市场对资本主义经济的平稳运行至关重要。

金融市场通过为企业和企业家分配资源和创造流动性, 在促进资本主义经济平稳运行方面发挥着至关重要的作用。市场使买卖双方更容易交易他们的金融资产。金融市场创造了证券产品,为拥有多余资金的人(投资者/贷方)提供回报,并将这些资金提供给需要额外资金的人(借款人)。

- 金融市场泛指进行证券交易的任何市场。

- 金融市场有很多种,包括(但不限于)外汇、货币、股票和债券市场。

- 这些市场可能包括在受监管的交易所上市或在场外交易 (OTC) 交易的资产或证券。

- 金融市场交易所有类型的证券,对资本主义社会的顺利运行至关重要。

- 当金融市场失灵时,可能会导致经济中断,包括衰退和失业。

金融市场常见问题

金融市场有哪些不同类型?

金融市场及其作用的一些例子包括股票市场、债券市场、外汇、商品和房地产市场等。金融市场也可以分为资本市场、货币市场、一级市场与二级市场、上市与场外市场。

金融市场如何运作?

尽管涵盖许多不同的资产类别并具有各种结构和法规,但所有金融市场的运作本质上都是通过将某种资产或合同中的买卖双方聚集在一起并允许他们相互交易来运作的。这通常通过拍卖或价格发现机制完成。

金融市场的主要功能是什么?

金融市场的存在有几个原因,但最基本的功能是允许在金融经济中有效分配资本和资产。通过允许资本、金融义务和货币流动的自由市场,金融市场使全球经济运行更加平稳,同时也允许投资者随着时间的推移参与资本收益。

为什么金融市场很重要?

没有金融市场,资本就无法有效配置,商业贸易、投资和增长机会等经济活动将大大减少。

EssayOne 金融代写优势

EssayOne自成立以来,7年间服务了超过20万名华人留学生。我们也都曾是学生,所以非常明白当面对突发的急、难学术研究问题时的那种无奈、无助、猝不及防的忧愁。因此我公司全力集结了一大批优秀人才和海外留学的精英tutor,力求能解决您可能遇到的每一个麻烦。

不论是在金融学带哪个领域,不论是在哪项专业课程,我们都有着最为顶尖的优秀写手,拥有最为丰富的学术服务经验,熟悉各类商学院的各种作业格式。我们拥有:

100%资深金融专家,他们都拥有金融学硕士或博士学位,且均就读于世界知名高校;

覆盖各种金融作业代写,各种难度的金融作业代写,网课代上,金融代考等,我们的专家都可以完成;

优质高分保障,高质量、原创性、高准确率,专家专业知识过硬,轻松获得高分,还可以提供作业讲解辅导;

按时提交作业,遵守交稿时间,绝不拖稿,还可以接12H内的急单

免费售后,全年365天无休的客服与助教为您服务,随时沟通,为您答疑解惑。

下面是一个Economics of Finanical Markets Assignment代写成功的案例:

This question asks you to choose any three individual stocks in the Australian Securities Exchange that have been traded in past 10 years and form your own optimal portfolio.1

(a) Find end-of-month price data for the three stocks you have chosen over the period December 2011 – December 2021, and compute their monthly returns for January 2012 – December 2021. Report what stocks you have chosen and the data source for their prices if you use a different data source than given in footnote

2.2

(b) (Report the sample average returns and sample standard deviations of returns on each stock, and the sample correlations among the returns on the three stocks. These statistics provide estimates for µj , σj , and ρij , for i, j = 1, 2, 3.3

(c) Pick any two stocks out of the three stocks you have chosen. Follow my solution to Exercise 4.1 to do the following:

(i) Plot the portfolio frontier with the two risky stocks in Excel or any other software. Report the figure.

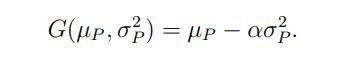

(ii) Suppose that you have a mean-variance objective as follows

Choose a value for α that best represents your degree of risk aversion. Find

your optimum portfolio, denoted as E2. Report the proportions of each stock

in E2 and (σE2, µE2).

(iii) Plot your indifference curves on the figure from (i) and depict the optimum

portfolio E2. Report the new figure.

(d) Now work with three stocks you have chosen. Construct the portfolio

frontier with the three stocks by numerically solve a minimum variance problem

as described in Topic 4, Section 3 (recall that the solution to this problem defines

the portfolio frontier with n risky assets). You can proceed as follows.

(i) Rewrite the minimum variance problem for n = 3 and report it.

(ii) In Excel or any other software, let a1, a2 vary between 0 and 1 and let

a3 = 1 − a1 − a2 (need to make sure a3 is within 0 and 1), and calculate

the µP and σ2P corresponding to each combination of (a1, a2, a3), using the estimated µj , σj , and ρij values you have found in part (b). No need to report values of (a1, a2, a3) and the corresponding (σP , µP ) values, just report how you vary a1 and a2 and how many combinations of (a1, a2, a3) you have considered.